Bytes and blocs are doing the heavy lifting now

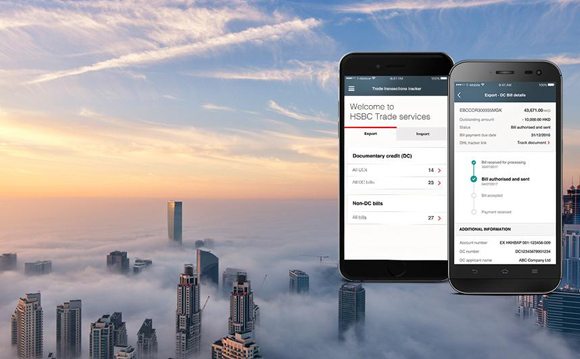

The way we all do business is changing. We can help you embrace new digital technology, to securely streamline the way you trade, and navigate the evolution of regional trade blocs with our global presence.

The first HSBC offices opened in 1865 in Hong Kong, Shanghai, London and San Francisco to support trade between Asia and the world. In the over 150 years since, HSBC has become a global network of thousands of offices in both established and fast-growing markets. We’ve remained steadfast in our purpose: to help our customers make the most of global opportunities. We work with millions of businesses to invest, expand and raise capital at home and abroad. We are Made for Trade because our customers are Made for Trade.

Trade in New Zealand

New Zealand is in a strong position to gain from trade opportunities across the globe and is one of the most open market economies in the world. Over the past three decades, successive Governments have reformed trade rules by removing many barriers to imports, ending most subsidies, and ensuring that the rules relating to foreign investment are designed to encourage productive foreign investment in New Zealand. New Zealand is consistently ranked by the World Bank and others as one of the most business-friendly countries in the world and have the belief that open markets and the free flow of trade are ultimately in everyone’s best interests1.

Trade Agenda 20302

In response to changes in the current global trade environment the New Zealand Department of Foreign Affairs & Trade has released 'Trade Agenda 2030 - Securing our place in the world' highlights four areas of focus over the next 10 - 15 years aiding New Zealanders to do business internationally:

- Continuing with urgency to build on our network of free trade agreements (FTAs) while also intensifying focus on implementation in order to maximise value from the agreements we already have

- Increased focus on non-tariff barriers / non-tariff measures, while still looking to address tariff peaks and tariff escalation

- Increasing our focus on services, investment and digital trade

- Appropriately assisting New Zealand businesses to succeed overseas