- Article

- Global Research

- Understand ESG

HSBC ESG Sentiment Survey #6

Our key findings

- In our sixth ESG survey, we find geopolitics and anti-ESG sentiment in the US are headwinds to sustainability

- But there's also room for optimism, as many are looking to advance their ESG analysis, finding more reasons to incorporate it, and considering a broader set of issues

- AI may be transformative, with investors contemplating its use to monitor, analyse or summarise sustainability issues

We are always being asked what investors are thinking and doing when it comes to environmental, social and governance (ESG) investing. So, in 2022, we launched a regular ESG survey.

Our sixth edition – conducted against the backdrop of continued anti-ESG sentiment in the US and geopolitical issues – captures the views of 291 respondents from 280 institutions representing USD8.9trn in assets under management (AUM). So what’s on their mind?

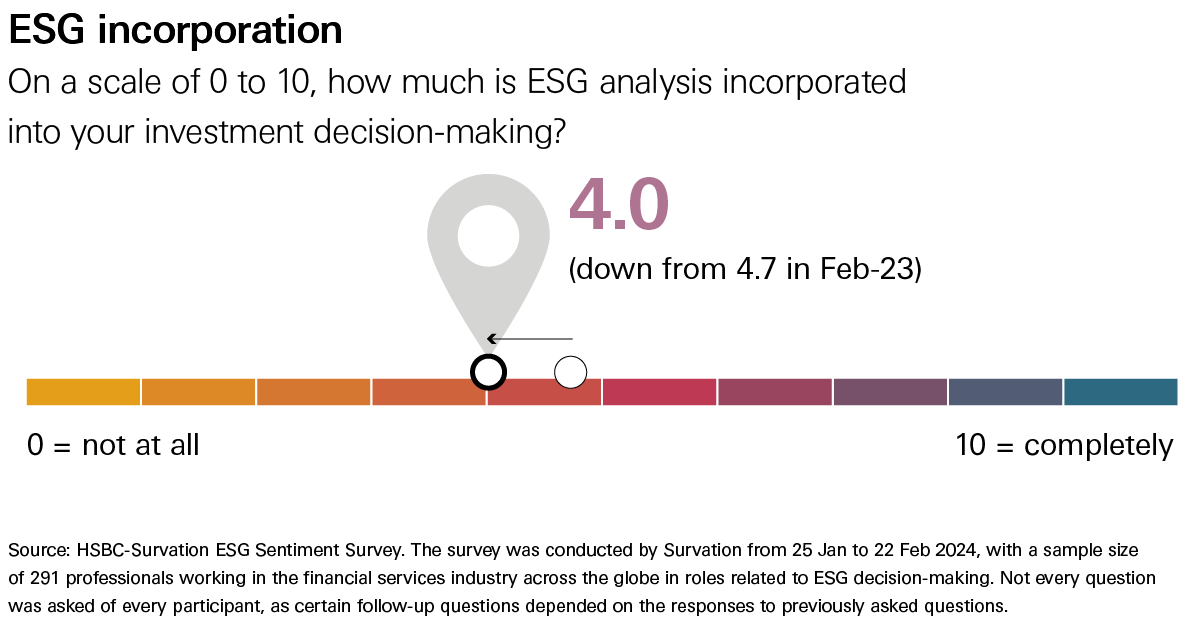

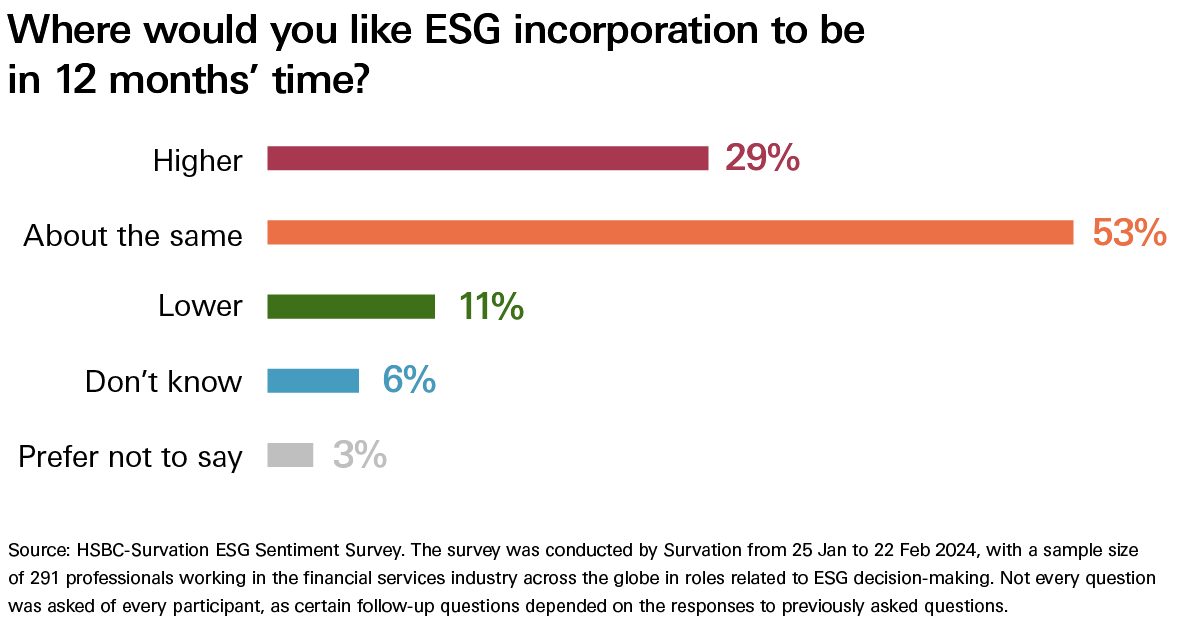

Peak ESG? While ESG is not trending as much, our survey shows that declines in sentiment are not universal across regions and asset classes. There are still sizable proportions of respondents who intend to increase ESG incorporation. We believe that ESG is undergoing an evolution – and what emerges on the other side should be more robust.

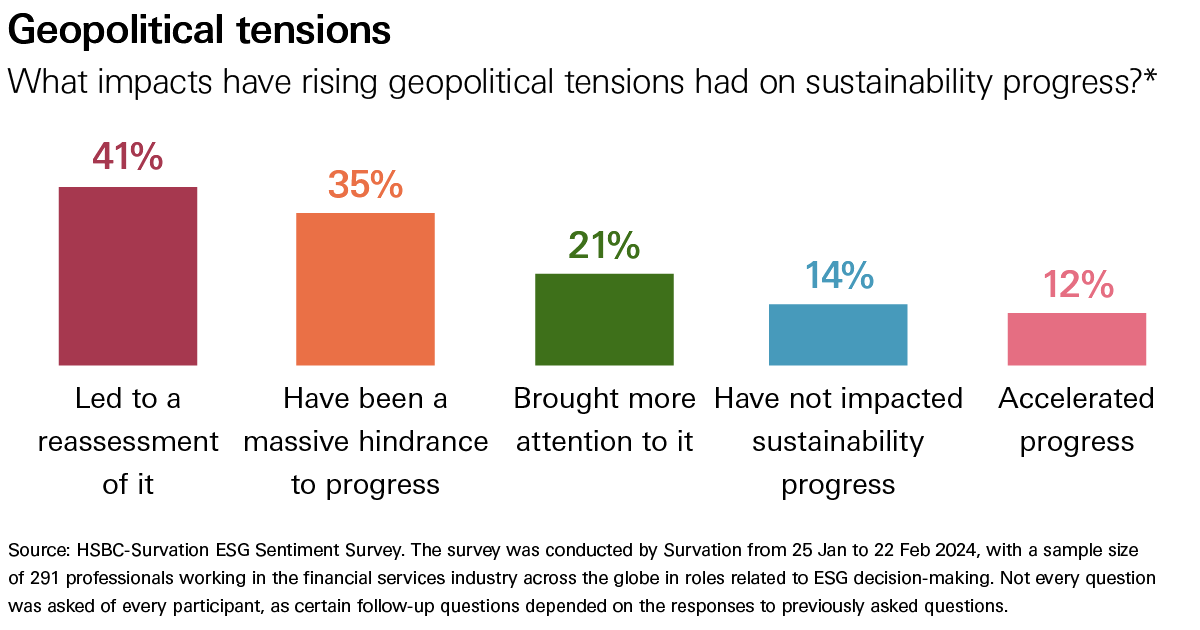

Geopolitics. As investors spend more time focusing on geopolitical risks, that leaves less time to consider sustainability risks or sustainability ambition.

Political abstraction. Anti-ESG sentiment has not necessarily grown stronger, but its influence has clearly widened – especially in the US, where elections loom. For example, membership of sustainable investing organisations is down, incorporation of ESG into decisions is down, and reasons for incorporating sustainability are weaker. However, other respondents are planning for more incorporation, for stricter standards, and for regulators to drive more ESG.

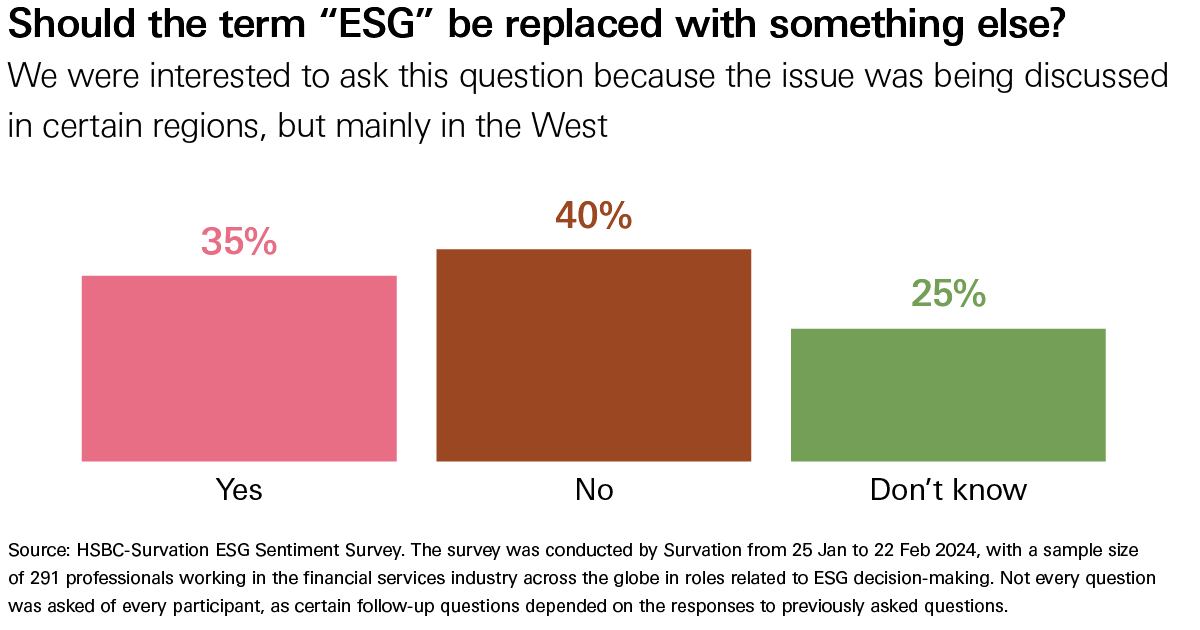

Nuanced calibration. Over a third of respondents thought the term “ESG” should be replaced, but even more thought that it should not be replaced. There is no clear alternative besides Responsible/Sustainable Investing, which is not new.

Turning it around. There is already a clear direction of travel when it comes to decarbonisation. Water-related issues and biodiversity are firmly on investors’ radar, however, as topics that do not yet receive the attention they deserve. Some respondents also pointed to social issues, such as freedom of speech and human rights, as worthy of greater attention.

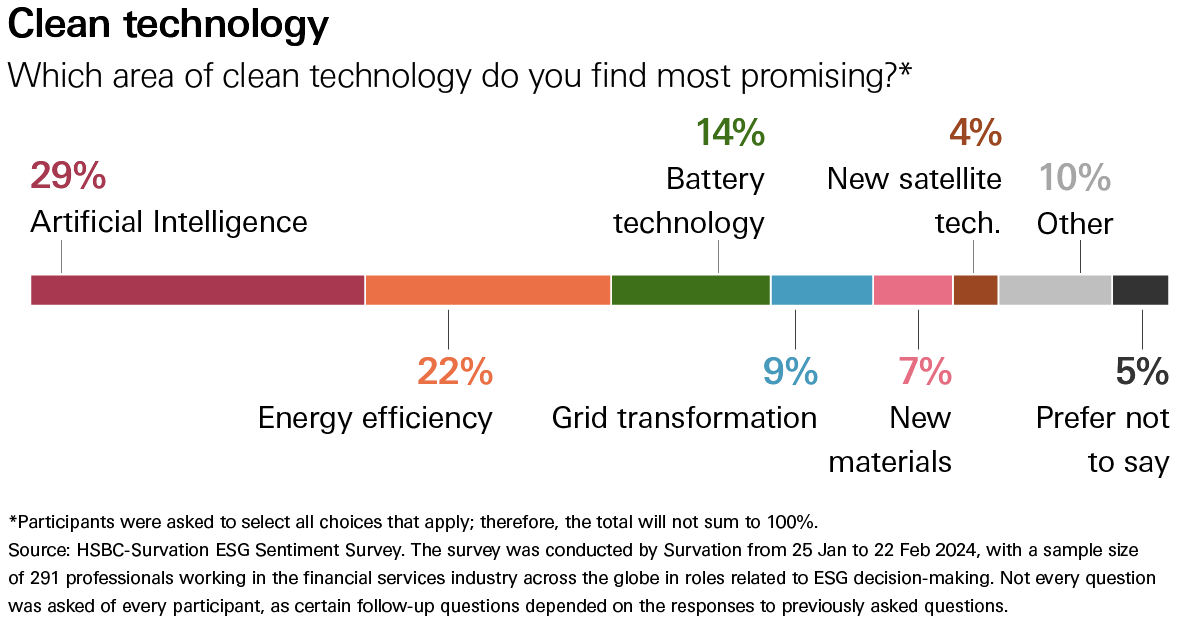

Artificial intelligence and ESG. Many investors are asking about how AI can change sustainability. Our survey respondents saw AI as the technology with the greatest potential to transform portfolios, ahead of other options such as batteries and energy efficiency measures. Many also intended to use AI as part of their sustainability research.

Would you like to find out more? Click here* to read the full report (you must be a subscriber to HSBC Global Research).

To find out more about HSBC Global Research or to become a subscriber email us at AskResearch@hsbc.com

Note: Our 1st ESG Sentiment Survey was conducted in February 2022, our 2nd Survey in June 2022, our 3rd Survey in October 2022, our 4th Survey in February 2023, and our 5th ESG Sentiment Survey was conducted in June 2023.